- Where Music's Going

- Posts

- Breakdown: Music Today & Tomorrow

Breakdown: Music Today & Tomorrow

Luminate Mid-Year Report & Music In the Air

Two big music industry reports just dropped:

The mid-year report from Luminate

Goldman Sachs’ forecasts (Music in the Air)

I analyzed both.

Come have a look at where we're going 👇

I’ll focus on 7 areas of opportunity:

1. Fandom is still an untapped opportunity.

How many people are superfans?

Luminate says 15% of us (over 13)

Goldman says 20%

But, superfans are under-monetized:

They spend 1.8x more than others now

But, spent 3x more than others in the download era

Streaming captures none of it with a single tier

📈 GS Forecasts: Superfan monetization creates net new revenue of $4.2B annually by 2030, mostly from premium streaming tiers where superfans pay 2x normies.

🧠 Streaming can capture some of superfan value. But most is gained in layers on top of streaming that offer something deeper & more connective.

You can’t just segment out & gouge superfans.

2. Direct Fan Relationships Matter More Than Ever

Direct to fan sales are up 20% in the US from last year.

VINYL: ↑26% | 2.1m→2.6m

CD: ↑15% | 1.5m→1.7m

CASSETTE: ↓15% | 73k→62k 🤔

And while only 27% of US streaming is current music..63% of direct to fan sales are.

🧠 A direct artist-fan relationship is increasingly valuable as streaming drowns out to catalog & 100k+ tracks per day. It's a move from monetizing attention to monetizing intent.

3. The Album is Making a Comeback

US physical album sales are up 13% from last year.

VINYL: ↑22% (23.6m) 🚀

CD: ↑4% (17.5m)

CASSETTE: ↑6% (212k) 🤏🏻

Hell, even CDs are up.

Only digital album downloads are down (↓12% to 9m).

📈 GS Forecasts: Physical to fall 15% from 2022 to 2030…up $2.9B → $3.9B from their previous forecast. I think they’ll need to make another edit after seeing this year’s growth.

🧠 There is huge opportunity to create a new digital album format that people love & put value on it. Something that lets the long tail of ever-increasing niche artists take advantage of this unit of fandom.

Is the vinyl growth all superstars?

If we model the rest of 2023 on 2022’s 2nd half behavior (it was 2.24× H1), we see the following:

Overall US Vinyl: ↑22% (43.5m → 52.9m)

Top 10 US Vinyl: ↓16% (3.1m → 2.6m)

This year’s growth is outside the Top 10 vinyl records.

The top 10 drove 7% of vinyl sales in 2022.

4.9% in 2023H1.

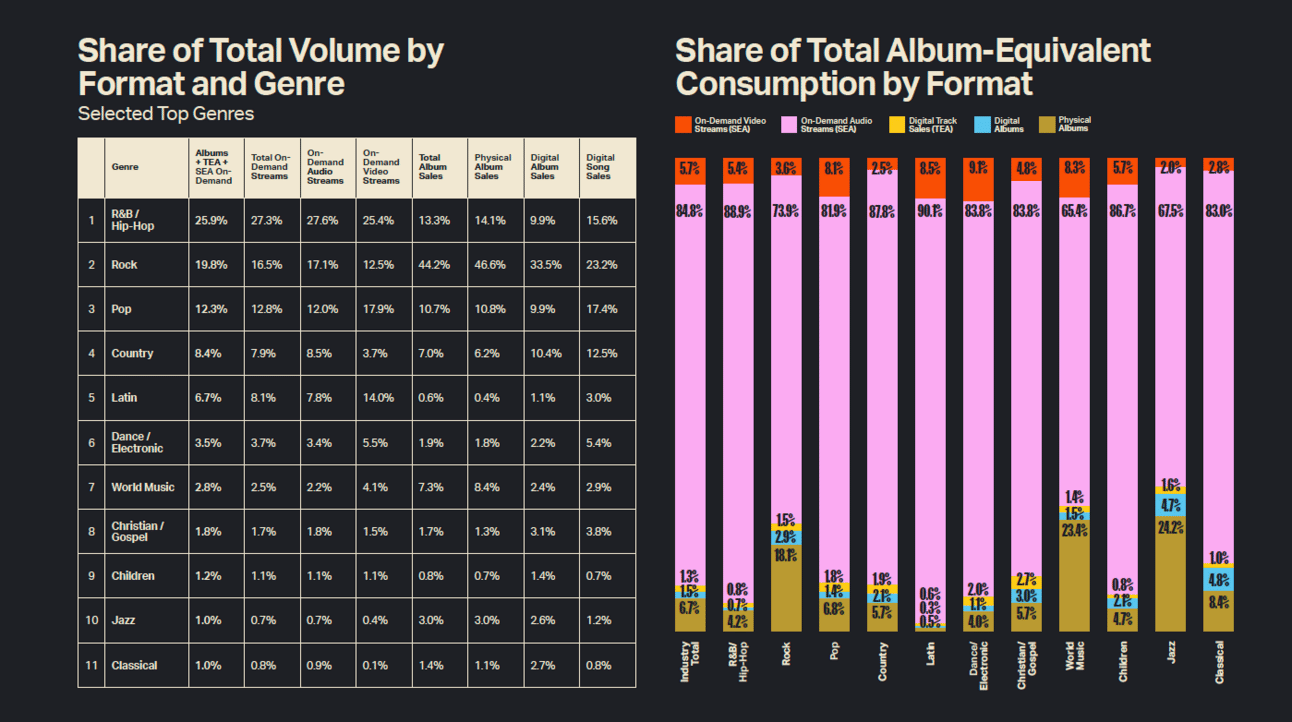

4. Rock’s Resurgence 🤘(and how different genres are consumed)

#2 most streamed genre

#1 album sales

#1 digital albums

#1 physical albums

#1 singles

Rock sells more physical albums than the next 7 genres combined 🤯

Rock: 46.6%

R&B/Hip-Hop: 14.1%

Pop: 10.8%

World: 8.4%

Country: 6.2%

Jazz: 3%

EDM: 1.8%

Christian: 1.3%

Classical: 1.1%

Children: 0.7%

Latin: 0.4% 😲

Rock isn’t just on top, it’s grown every year since 2019

2019: 42.2%

2020: 44%

2021: 44.3%

2022: 45.4%

2023H1: 46.6%

And has moved from 14.7% → 17.1% in stream share in that time.

5. Streaming’s Growing Globally, but…

Streaming is up 31% globally in 2023-H1

Asia: +107% 👀

Latin America: +70%

Europe: +57%

US: +15%

And GS forecasts paying subscribers will grow 103% by 2030

2022: 589m

2023E: 663m

2024E: 738m

2030E: 1.2b

But monetization is bad & getting worse:

Revenue per stream: ↓20% from 2017-2022

Spotify streaming hours: ↑5x 2015-2021

Global streaming ARPU: ↓40% since 2016 (when Spotify & Apple launched family plans)

Spotify now earns 4x less per hour streamed than Netflix.

📈 GS Forecasts: 3% price increases annually thru 2030 (on avg).

🧠 Apple, Amazon, Tidal & Youtube Music all raised prices this year. Spotify’s tests have shown no churn. I expect a rise soon, perhaps in tandem with the rumored “Supremium” HiFi tier.

6. Streaming’s Model is Broken

Goldman thinks 2 things need to change or evolve:

Treating all 30+ second streams the same

The pro-rata model

They call out 3 reasons:

Rise of streaming fraud

Explosion in the amount of music being released

Propensity of algorithms to push lower royalty content

🧠 I think pro-rata is done. But we need to make sure indie artists aren’t thrown into some “non-premium” category.

7. Emerging Platforms Rising Market Share

Emerging platforms paid $1.57b to the music industry in 2022.

Facebook: 23%

Gaming: 19%

Peloton: 17% 👀

TikTok: 14%

Youtube Shorts: 8%

Podcasts: 7%

Snapchat: 7%

Reels: 5%

(Yes, Peloton paid more to the music industry than TikTok.)

📈 GS Forecast: Emerging platform revenue will go from 6% of recorded music revenues to 14% in 2030. That’s $1.57B in 2022 to $7B in 2030.

🧠 This feels wide open. Any one of these could lead or be gone. Or, a new platform could emerge to take over far more share than this. We’re on the cusp of a change. Everyone feels it.

All statistics can be found in Luminate’s Mid-Year 2023 Report or Music in the Air.